What translators and interpreters absolutely need to know

For many translators and interpreters, language and precision are everyday tools – both in communication and in their profession. But when it comes to invoicing, things often get more complicated. Small businesses in Germany in particular are subject to special tax regulations that provide relief but also entail obligations. Knowing the most important basics can save time and hassle – and help you appear professional.

1. Small Businesses Regulation: Advantages and Limits

The small business regulation under Section 19 of the German Value Added Tax Act (UStG) allows self-employed persons with lower annual sales to not include sales tax on their invoices. This eliminates the obligation to submit monthly sales tax returns, which simplifies accounting.

You are considered a small business owner if:

- the previous year’s turnover did not exceed EUR 25,000 and

- turnover in the current year is not expected to exceed EUR 100,000.

Benefits:

- Simplified accounting and less administrative work.

- No declaration and no payment of sales tax.

- A lower price can be attractive to private customers.

Limits:

- No input tax deduction.

- Often less attractive for larger corporate customers, as they cannot claim input tax.

- If the turnover limits are exceeded, the status is automatically revoked – and the obligation to pay sales tax applies retroactively.

A precise overview of sales and ongoing projects is therefore essential.

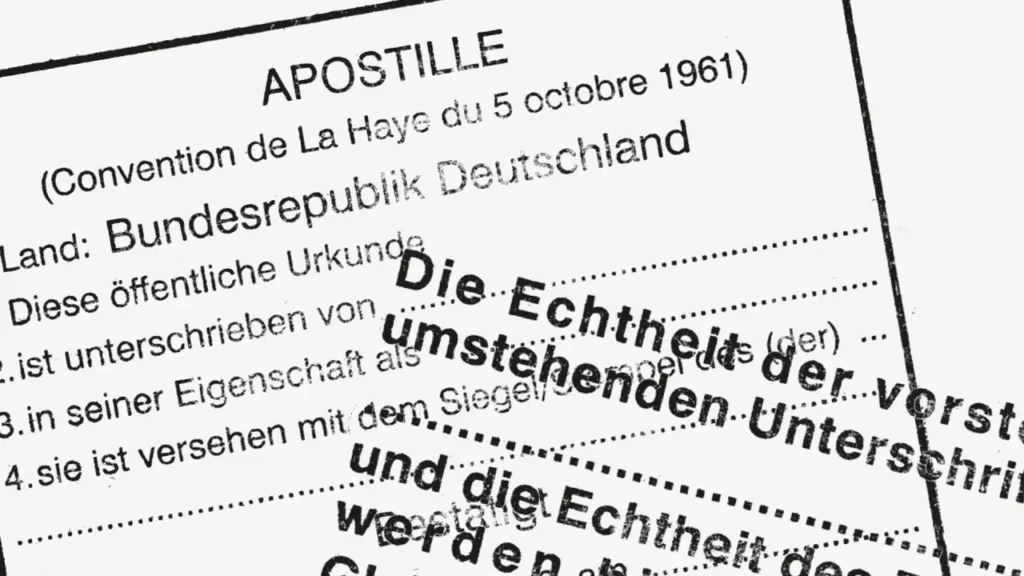

2. Mandatory Information on a Small Business Invoice

Even without sales tax, all mandatory information must be correct and complete. An incorrect invoice cannot be accepted for tax purposes.

The following information is required:

- Full name and address of the invoice issuer and the customer

→ An incorrect recipient address invalidates the invoice and requires a new one to be issued. - Invoice date

- Sequential and unique invoice number

→ For example: 2025-10-1, 2025-135, or Translation-127. - Date or period of service

- Detailed description of the service provided

- Fee or price (gross = net)

- Tax number or VAT ID

→ A missing number may be interpreted as an indication of undeclared work. - Reference to the application of the small business regulation pursuant to Section 19 of the German Value Added Tax Act (UStG) → For example: “In accordance with Section 19 UStG, no sales tax is charged.”

3. Simplifications and Special Cases

Small-value Invoices

Simplified requirements apply to invoices up to EUR 250 (gross). The following is sufficient:

- Name and address of the issuer of the invoice

- Date of issue

- Description of the service

- Payment and tax amount in one sum

- Reference to the small business regulation

Information such as invoice number, service date or complete customer data is not required here.

Invoices to Other EU Countries

The reverse charge procedure may apply to services provided to companies in other EU countries. This means that VAT is not paid in Germany, but in the country of the recipient of the service.

In addition, many translation services are not taxable abroad – it is worth consulting your tax advisor in this regard.

Digital Invoices and e-Invoices

Sending invoices by email in PDF format is currently sufficient in Germany.

However, starting in 2025, the transition to structured e-invoices that use specific data formats (e.g., XML) will begin. Transition periods are expected to last until the end of 2026, and in some cases even until the end of 2027.

Currently, it is sufficient to have a suitable email account and to securely archive digital receipts.

4. Common Mistakes and how to Avoid Them

- Incorrect address details or recipient: Invoice becomes invalid and must be reissued.

- Reusing old templates: Date, customer data, or amounts not adjusted – a frequent source of errors.

- Invoice number assigned twice: Each number must be unique; preferably with a year reference (e.g., 2025-10-01).

- Sales tax accidentally added: Small business owners are not allowed to charge it.

- Unclear service description: It must be clearly identifiable who performed which service and when.

A sample invoice is also available for download on the ReSartus website, which can be used as a template.

5. Special Considerations for Language Service Providers

Service description

For translations: language, scope (e.g., number of words or lines) and deadline

For interpreting services: type of service (simultaneous, consecutive), location and date of assignment.

If there is a file number or order number, this helps the invoice recipient to assign the invoice internally.

Compensation models

In addition to hourly or per-word rates, flat rates are also common.

Advantages: simple calculation, clear costs for the customer.

Disadvantages: risk of additional expenses – but also potential for profit if work is done efficiently.

Please note: If you do not explicitly indicate this when confirming the order, the JVEG does not apply to interpreting appointments for private and business clients, for example – it only applies to court appointments!

Payment terms

Clearly defined payment terms (e.g., 14 days) create transparency. For invoices to companies and public authorities, a payment term of 30 or 60 days is usually agreed upon. In the case of judicial, state, and federal authorities, this may take longer, as several internal approvals are often required.

In some cases, credit notes can be agreed upon – the customer creates the invoice themselves, for example, in the case of long-term cooperation.

6. Digitize Accounting - with Clarity and Efficiency

Digital accounting offers many advantages:

- Keep track of invoices, incoming payments and due dates.

- Reminders can be sent automatically.

- Receipts and invoices are archived in an audit-proof manner.

- Programs provide support in creating legally compliant invoices and in exporting data to the tax advisor.

Many solutions are available from around EUR 10 per month – tax-deductible and ideal for small business owners.

A proven and cost-effective option is sevDesk – user-friendly, cloud-based, and specifically tailored to freelancers. You can also use it to create e-invoices – completely free of charge.

Conclusion

Invoices are more than just a formal obligation – they reflect professionalism and reliability. Translators and interpreters, who often work internationally and on a project basis, benefit particularly from clear structures. Understanding the small business regulation, knowing the mandatory information and using digital tools creates a solid basis for efficient, legally compliant work.

Push the Future

Small Businesses and Invoices

Vegan Language – It’s all about the Bratvurst

Accessible Texts – Leichte Sprache from a Translator’s Perspective

Between Deadlines and Diplomacy

Why localization is more than translation

60th Theodor Heuss Prize

The invisible danger: digital translation fraud

Planned revision of the JVEG

Freelancer visa in the UAE

Emigration to Dubai

Cuts and restrictions – Interpreters and Translators in Crisis

Building bridges at the Wilhelm Bock Prize

Funding Programs for Language Mediators in Healthcare

Inclusion in Education: ReSartus Enables International Exchange

The Future of Remote Interpreting – Virtual Conferences

Industry-specific challenges in the translation industry

The Role of AI in the Translation Industry

Hiiios – The video interpreting service by ReSartus

Emigrating from Germany

ReSartus supports the 43rd Erlangen Poetry Festival

Preparations for the COP 28 World Climate Conference

Push the Future

Small Businesses and Invoices